Environmental Protection Tax Law of the People's Republic of China

(Adopted at the Twenty-fifth Meeting of the Standing Committee of the Twelfth National People's Congress on December 25, 2016)

Table of Contents

Chapter I General Provisions

Chapter II Taxation basis and taxable amount

Chapter III Tax Deduction

Chapter IV Collection and Management

Chapter 5 Supplementary Provisions

Chapter I General Provisions

Article 1 In order to protect and improve the environment, reduce pollutant emissions, and promote the construction of ecological civilization, this Law is enacted.

Article 2 In the territory of the People's Republic of China and other maritime areas under the jurisdiction of the People's Republic of China, enterprises, institutions and other production operators that directly discharge taxable pollutants into the environment are taxpayers of environmental protection tax and shall pay environmental protection tax in accordance with the provisions of this Law.

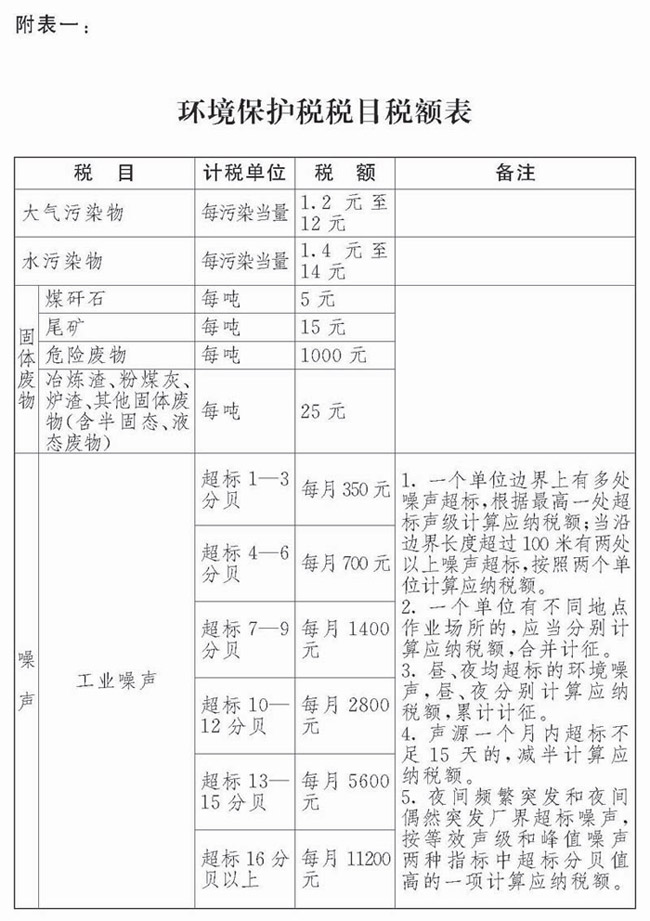

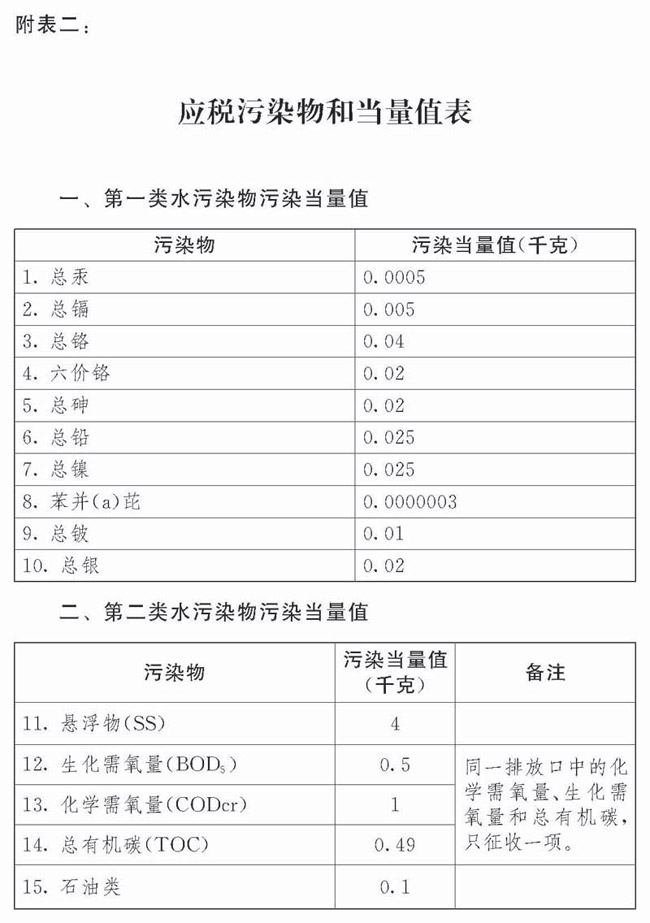

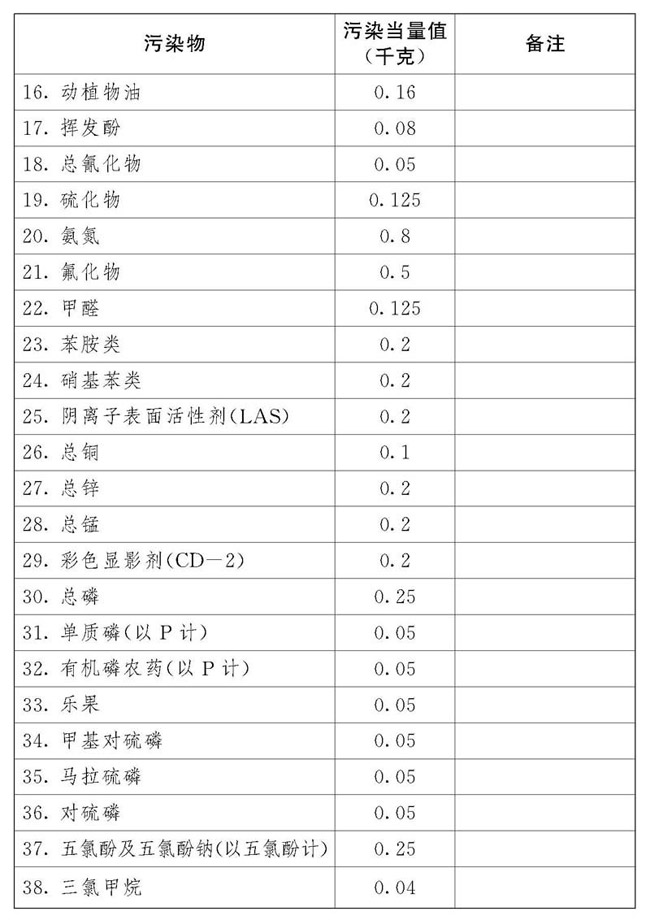

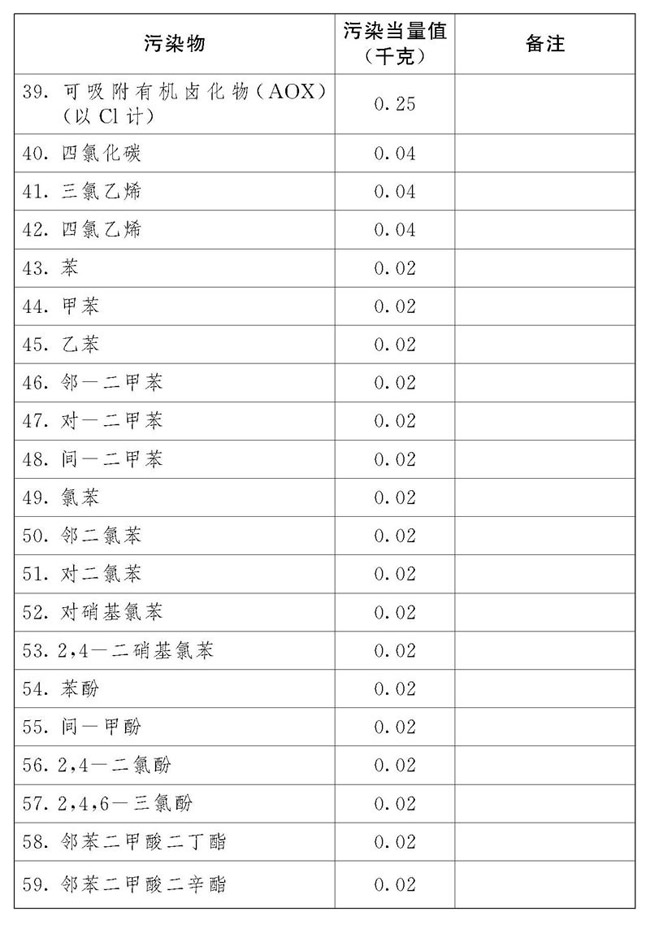

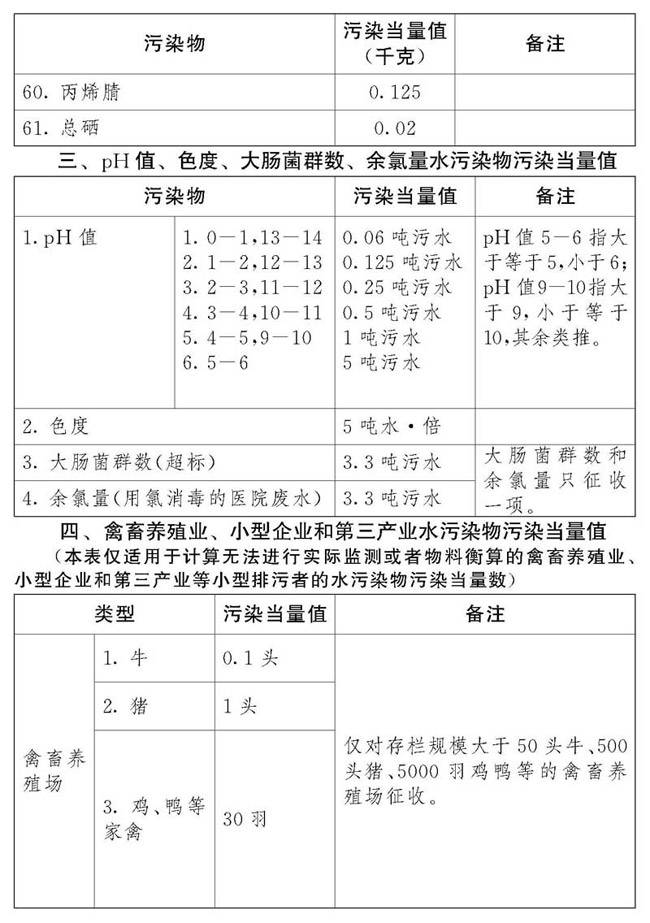

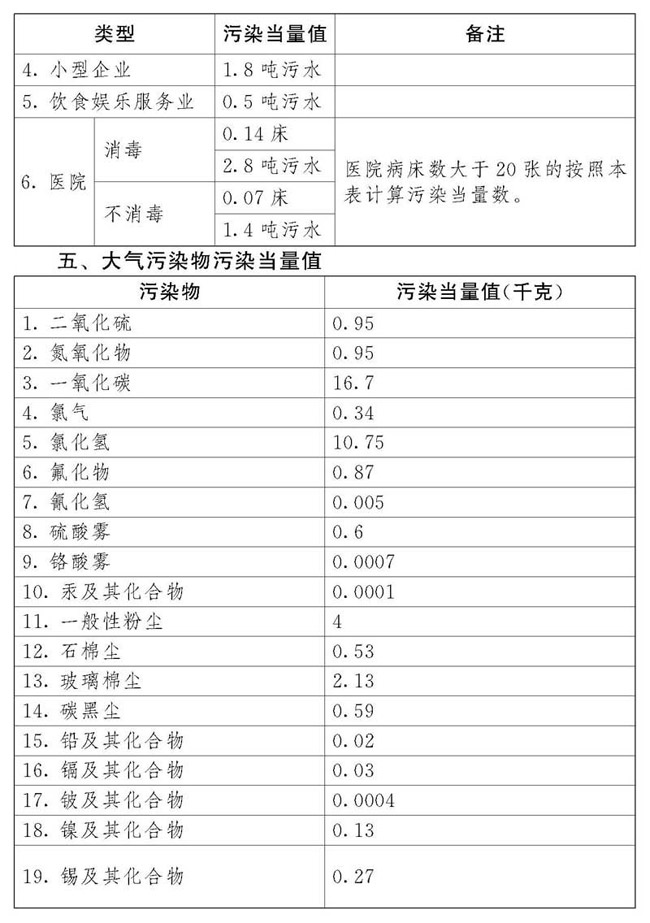

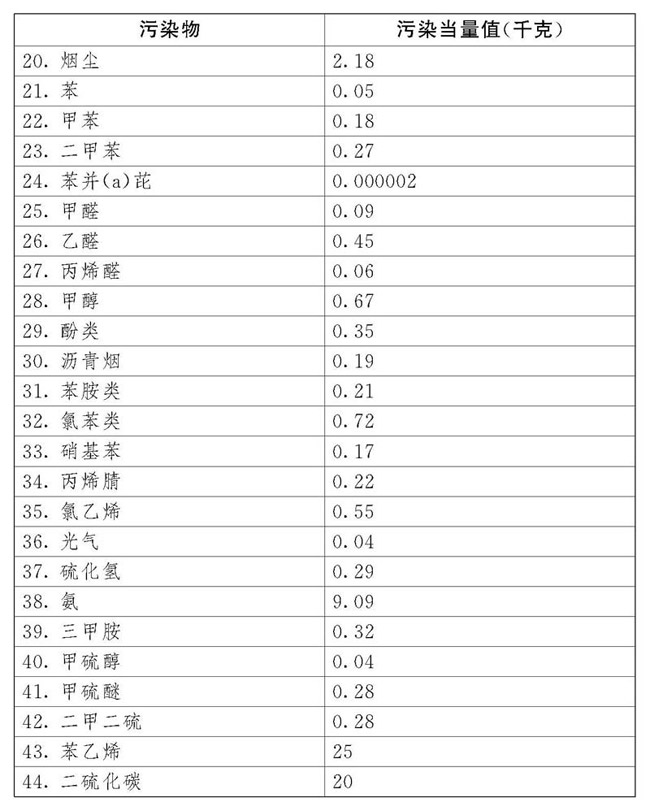

Article 3 The taxable pollutants referred to in this Law refer to the air pollutants, water pollutants, solid wastes and noise specified in the "Tax Table of Environmental Protection Tax" and "Taxable Pollutants and Equivalent Value Table" attached to this Law.

Article 4 One of the following circumstances is not a direct discharge of pollutants into the environment, not to pay the corresponding pollutants of environmental protection tax.

(a) enterprises, institutions and other production operators to the centralized treatment of sewage, domestic waste centralized treatment sites established by law, the discharge of taxable pollutants.

(b) enterprises, institutions and other production operators in line with national and local environmental protection standards of facilities, places to store or dispose of solid waste.

Article 5 The centralized treatment of urban and rural sewage, centralized treatment of domestic waste sites established in accordance with the law exceed the national and local emission standards for the discharge of taxable pollutants into the environment, shall pay environmental protection tax.

Enterprises, institutions and other production operators storage or disposal of solid waste does not meet national and local environmental protection standards, shall pay environmental protection tax.

Article 6 The tax items and tax amounts of the environmental protection tax shall be implemented in accordance with the "Tax Table of Environmental Protection Tax" attached to this Law.

The determination and adjustment of the specific applicable taxes on taxable air pollutants and water pollutants shall be made by the people's governments of provinces, autonomous regions and municipalities directly under the Central Government, taking into account the environmental carrying capacity of the region, the current situation of pollutant emissions and the requirements of economic and social ecological development goals, within the tax range specified in the "Environmental Protection Tax Table" attached to this Law, and reported to the Standing Committee of the People's Congress at the same level for decision, and reported to the The Standing Committee of the National People's Congress and the State Council shall file the decision.

Chapter II Taxation Basis and Taxable Amount

Article 7 The basis of taxation of taxable pollutants shall be determined in accordance with the following methods.

(a) Taxable air pollutants shall be determined in accordance with the equivalent amount of pollutant emissions.

(b) taxable water pollutants are determined in accordance with the equivalent number of pollutants emitted; (C) taxable solid wastes are determined in accordance with the equivalent number of pollutants emitted.

(C) taxable solid waste is determined in accordance with the emissions of solid waste.

(d) taxable noise is determined in accordance with the decibel level in excess of the national standard.

Article 8 The pollution equivalent number of taxable air pollutants and water pollutants shall be calculated by dividing the emission of the pollutant by the pollution equivalent value of the pollutant. Each taxable air pollutants, water pollutants, the specific pollution equivalent value, in accordance with the Law attached to the "taxable pollutants and equivalent value table".

Article IX of each emission port or no emission port taxable air pollutants, according to the number of pollution equivalents in descending order, the first three pollutants levied on environmental protection tax.

Each discharge of taxable water pollutants, in accordance with the Law attached to the "taxable pollutants and equivalent value table", distinguish between the first category of water pollutants and other categories of water pollutants, in accordance with the number of pollution equivalents in descending order, the first five water pollutants in accordance with the first five environmental protection tax, the first three water pollutants in accordance with the first three environmental protection tax.

Provinces, autonomous regions, municipalities directly under the Central People's Government in accordance with the special needs of the region's pollutant emissions reduction, can increase the number of taxable pollutants levied on the same discharge environmental protection tax items, reported to the Standing Committee of the People's Congress at the same level, and reported to the Standing Committee of the National People's Congress and the State Council for the record.

Article 10 Taxable air pollutants, water pollutants, solid waste emissions and decibels of noise shall be calculated in accordance with the following methods and order.

(a) taxpayers installed and used in accordance with national regulations and monitoring norms of automatic monitoring equipment of pollutants, calculated in accordance with the automatic monitoring data of pollutants.

(b) Where the taxpayer has not installed and used automatic monitoring equipment for pollutants, the calculation shall be made in accordance with the monitoring data issued by the monitoring agency in accordance with the relevant state regulations and monitoring norms.

(c) If the monitoring conditions are not available due to the many types of pollutants emitted, the calculation shall be made in accordance with the emission coefficients and material accountancy methods prescribed by the competent department of environmental protection under the State Council.

(d) can not be calculated in accordance with the methods specified in the first to third subparagraphs of this Article, in accordance with the approved methods of sampling and calculation prescribed by the competent department of environmental protection of the people's governments of provinces, autonomous regions and municipalities directly under the Central Government.

Article 11 The taxable amount of environmental protection tax shall be calculated in accordance with the following methods.

(a) The taxable amount of taxable air pollutants is the number of pollution equivalents multiplied by the specific applicable tax amount.

(b) the taxable amount of taxable water pollutants is the number of pollution equivalents multiplied by the specific applicable tax amount.

(c) The taxable amount of taxable solid waste is the amount of solid waste emissions multiplied by the specific applicable tax amount.

(d) the taxable amount of taxable noise is the specific applicable tax amount corresponding to the number of decibels exceeding the national standard.

Chapter III tax relief

Article 12 The following circumstances shall be temporarily exempted from environmental protection tax.

(A) agricultural production (excluding large-scale farming) emissions of taxable pollutants.

(B) motor vehicles, railroad locomotives, non-road mobile machinery, ships and aircraft and other mobile sources of pollutants emitting taxable pollutants.

(C) the discharge of corresponding taxable pollutants from urban and rural sewage centralized treatment and domestic waste centralized treatment sites established by law, which do not exceed the emission standards stipulated by the state and local regulations

(D) The taxpayer's comprehensive utilization of solid waste, which meets national and local environmental protection standards

(E) Other circumstances approved by the State Council for tax exemption.

The fifth exemption provision of the preceding paragraph shall be reported by the State Council to the Standing Committee of the National People's Congress for the record.

Article 13 The taxpayer emits taxable air pollutants or water pollutants with a concentration value of less than thirty percent of the national and local pollutant emission standards, a reduction of seventy-five percent of the environmental protection tax. Taxpayers emitting taxable air pollutants or water pollutants with a concentration value of less than fifty percent of the national and local pollutant emission standards, a reduction of fifty percent of the environmental protection tax.

Chapter IV Collection and Management

Article 14 The environmental protection tax shall be levied and collected by the taxation authorities in accordance with the "Tax Levy and Administration Law of the People's Republic of China" and the relevant provisions of this Law.

Environmental protection authorities in accordance with this Law and the provisions of relevant environmental protection laws and regulations is responsible for the monitoring and management of pollutants.

Local people's governments at or above the county level shall establish a working mechanism of division of labor and cooperation among taxation authorities, environmental protection authorities and other relevant units to strengthen the collection and management of environmental protection taxes and to ensure that the taxes are deposited in full and on time.

Article 15 The competent departments of environmental protection and taxation authorities shall establish a platform for sharing tax-related information and a mechanism for working together.

The competent environmental protection departments shall regularly deliver to the taxation authorities information related to environmental protection, such as emission permits of emission units, pollutant emission data, environmental violations and administrative penalties.

The taxation authorities shall regularly transmit to the competent department of environmental protection the tax information related to environmental protection tax such as tax declaration, tax deposit, tax reduction and exemption, tax arrears and risk suspicion of the taxpayer.

Article 16 The time of tax obligation shall be the day when the taxpayer discharges taxable pollutants.

Article 17 The taxpayer shall declare and pay the environmental protection tax to the tax authority where the taxable pollutant is emitted.

Article 18 The environmental protection tax shall be calculated on a monthly basis and declared and paid on a quarterly basis. If it cannot be calculated and paid by a fixed period, it can be declared and paid on a quarterly basis.

When the taxpayer declares payment, he shall submit to the tax authorities the type and quantity of taxable pollutants emitted, the concentration values of air pollutants and water pollutants, and other tax information that the tax authorities require the taxpayer to submit according to actual needs.

Article 19 of the taxpayer to pay quarterly declarations shall, within fifteen days from the end of the quarter, to the tax authorities for tax declaration and payment of taxes. The taxpayer shall file a tax return and pay tax to the tax authorities within fifteen days from the date of occurrence of the tax obligation.

Taxpayers shall truthfully handle tax declarations in accordance with the law, and take responsibility for the authenticity and completeness of the declaration.

Article 20 The taxation authorities shall compare the data and information of the taxpayer's tax declaration with the relevant data and information handed over by the competent department of environmental protection.

If the taxation authority finds that the taxpayer's tax declaration data is abnormal or the taxpayer fails to file the tax declaration in accordance with the prescribed period, it may request the competent department of environmental protection to conduct a review, and the competent department of environmental protection shall issue a review opinion to the taxation authority within fifteen days from the date of receiving the data information from the taxation authority. The taxation authority shall adjust the taxable amount of the taxpayer in accordance with the data and information reviewed by the competent department of environmental protection.

Article 21 Where the calculation of pollutant emissions is approved in accordance with the provisions of Paragraph 4 of Article 10 of this Law, the taxation authorities, in conjunction with the competent department of environmental protection, shall approve the type, quantity and taxable amount of pollutant emissions.

Article 22 The taxpayer engaged in marine works to discharge taxable air pollutants, water pollutants or solid waste into the waters under the jurisdiction of the People's Republic of China, the specific method of declaring and paying environmental protection tax shall be prescribed by the competent taxation department under the State Council in conjunction with the competent marine department under the State Council.

Article 23 Taxpyers and taxation authorities, environmental protection authorities and their staff violate the provisions of this Law, in accordance with the "Tax Collection and Administration Law of the People's Republic of China", "Environmental Protection Law of the People's Republic of China" and the provisions of relevant laws and regulations to pursue legal responsibility.

Article 24 The people's governments at all levels shall encourage taxpayers to increase investment in environmental protection construction and provide financial and policy support for taxpayers' investment in automatic monitoring equipment for pollutants.

Chapter V Supplementary Provisions

Article 25 The meaning of the following terms of this Law.

(a) pollution equivalent, is a comprehensive indicator or unit of measurement of environmental pollution of different pollutants according to the harmfulness of pollutants or pollution emission activities to the environment and the technical economy of treatment. The same medium with the same pollution equivalent of different pollutants, the degree of pollution is basically equivalent.

(b) emissions coefficient, is the statistical average of the amount of pollutants that should be discharged in the production of a unit of product under normal technical and economic and management conditions.

(c) material accountancy, refers to a method of measuring the production process according to the principle of conservation of material mass of raw materials used, products produced and waste generated.

Article 26 The direct discharge of taxable pollutants into the environment of enterprises and other production operators, in addition to paying environmental protection tax in accordance with the provisions of this Law, shall be responsible for the damage caused by law.

Article 27 From the date of implementation of this Law, environmental protection tax shall be levied in accordance with the provisions of this Law, and no longer levy sewage charges.

Article 28 This Law shall come into force on January 1, 2018.

Translated with www.DeepL.com/Translator (free version)